XRP Price Prediction: Analyzing Short-term Technicals and Long-term Catalysts Through 2040

#XRP

- ETF Catalyst Timeline - October and November ETF decisions could serve as immediate price catalysts, with approval potentially driving XRP toward $7 according to analyst projections

- Technical Support Holding - Current price action maintains critical support at $2.77 while Bollinger Bands suggest consolidation between $2.71-$3.24, with MACD indicating bullish momentum building

- Institutional Accumulation Pattern - Significant whale activity and corporate purchases (notably Gumi's strategic acquisition) indicate strong institutional confidence despite short-term market volatility

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Support

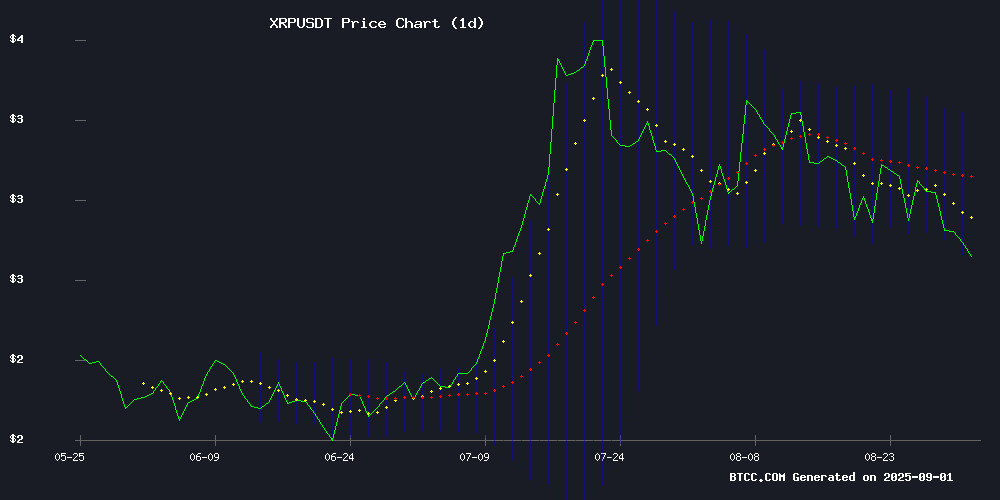

XRP is currently trading at $2.7649, holding above the critical $2.77 support level. The price remains below the 20-day moving average of $2.9741, indicating short-term bearish pressure. MACD readings show a positive momentum with the MACD line at 0.1599 above the signal line at 0.1277, generating a bullish crossover signal of 0.0322. Bollinger Bands position the price between the upper band at $3.2360 and lower band at $2.7123, suggesting a consolidation phase. According to BTCC financial analyst James, 'The current technical setup suggests XRP is testing key support levels while maintaining overall bullish structure. A hold above $2.71 could pave the way for a retest of the $3.00 resistance zone.'

Market Sentiment: ETF Optimism and Institutional Accumulation Drive Positive Outlook

Market sentiment for XRP remains overwhelmingly positive driven by multiple catalysts. Recent headlines highlight ETF approval possibilities, with analysts suggesting potential targets reaching $7 upon regulatory clearance. The October-November timeline for ETF decisions is creating substantial market anticipation. Japanese company Gumi's significant XRP purchase demonstrates growing institutional interest, while whale accumulation during September's bearish start indicates strong confidence at current levels. BTCC financial analyst James notes, 'The convergence of regulatory clarity, ETF potential, and institutional demand creates a fundamentally strong backdrop for XRP. While short-term volatility may persist, the structural bullish narrative remains intact with key resistance at $3.00 representing the next major hurdle.'

Factors Influencing XRP's Price

XRP Volatility Widens as Price Holds $2.77 Support

XRP's price action between August 31 and September 1 showcased heightened volatility, with the token oscillating between $2.70 and $2.84. Whale accumulation of 340 million XRP over two weeks signals institutional confidence, countering short-term bearish pressure. On-chain activity surged during the September 1 rebound, with 164 million tokens traded—more than double the session average.

The $2.70–$2.73 support zone held firm, reinforced by whale buying, while resistance at $2.80–$2.84 remains a key hurdle. September's historical weakness in crypto markets looms, but institutional accumulation may offset retail liquidation flows.

Technical indicators show neutral momentum, with RSI hovering in the mid-40s. The next upside threshold lies at $2.87–$3.02, but consolidation near $2.80–$2.81 confirms lingering selling pressure.

ETF Approval Could Propel XRP to $7 as Analysts Adjust Price Targets

XRP stands at a critical technical juncture as the SEC's mid-October decision on spot ETFs approaches. The cryptocurrency, trading near key support at $2.70, faces resistance between $3.00 and $3.30—a breakout could signal a rally toward $4-$7 targets set by 99Bitcoins analysts. "Corrections redistribute supply to stronger hands and support long-term growth," notes David Hernandez of 21Shares, highlighting September's traditional dip-buying opportunity.

Market dynamics reveal a tug-of-war: $2.87 billion in futures open interest reflects bullish leverage positioning, while whales have accumulated 340 million XRP tokens worth nearly $1 billion. Yet weekend sell-offs saw $1.9 billion worth of XRP flood back into markets, creating divergence among institutional players. Technical analysts outline a clear bullish path—hold $2.70, breach $2.90, then target $3.70—as ETF speculation fuels volatility.

XRP Price Prediction 2025: Regulatory Clarity and Institutional Demand Fuel Optimism

As 2025 approaches its conclusion, XRP remains a focal point in the cryptocurrency market. Regulatory clarity in the U.S., growing institutional interest, and expanding use cases on the XRP Ledger (XRPL) are driving bullish sentiment. Analysts present a range of projections, from conservative estimates of $3 to optimistic scenarios surpassing $10, depending on catalysts like ETF approvals and market rallies.

Changelly forecasts an average price of $3.04 by year-end, with a trading range of $2.98 to $3.32. CoinCentral and Bitget offer more aggressive targets, suggesting $5 or higher if institutional demand accelerates and regulatory support for crypto ETPs strengthens. The most ambitious predictions hinge on a confluence of factors, including spot ETF approvals and rapid adoption of tokenized assets on XRPL.

Emerging tokens like Remittix (RTX) are also gaining attention, offering alternative growth narratives. Yet XRP's established infrastructure and regulatory progress position it as a standout contender for sustained gains.

Three Catalysts for XRP's Potential Rally to $3.00

XRP remains significantly below its all-time high of $3.66, but emerging trends suggest a brewing recovery. Whale accumulation, spot ETF momentum, and corporate treasury adoption are converging to potentially reignite bullish momentum.

Large holders have stealthily amassed billions of XRP during recent dips, with whale wallets holding 1M+ tokens reaching 2,743 addresses. This accumulation mirrors patterns seen before previous rallies.

The ETF landscape is heating up, with multiple U.S. filings progressing alongside regulatory clarity. Analyst confidence in approval is growing, which could unlock institutional demand.

Tokyo-based Gumi's plan to allocate $17 million to XRP treasury holdings marks an early corporate adoption case. Such real-world use cases could validate XRP's utility beyond speculative trading.

XRP Price Holds Key Support Amid ETF Optimism

XRP has rebounded from August's sharp decline, rising 1.40% on September 1st to hold critical support at $2.75. Traders eye the $3.0 level as a pivotal zone, with a breakout potentially fueling a move toward $3.70 and beyond.

Market sentiment brightened after Nate Geraci highlighted undervalued investor demand for XRP ETFs, drawing parallels to the early days of spot Bitcoin and Ethereum ETFs. ProShares' UXRP ETF success post-SEC legal resolution further bolstered bullish momentum.

Updated ETF filings from Grayscale, Bitwise, and Canary suggest growing institutional interest. The $3.66 all-time high remains a psychological benchmark as technicals and fundamentals align for potential upside.

XRP ETF Approval Timeline: October and November Could Change Everything

The XRP community anticipates a pivotal moment this fall as the U.S. SEC approaches critical deadlines for multiple spot XRP ETF applications. Mid-October will see a flurry of rulings, starting with Grayscale's XRP ETF on October 18, followed by 21Shares on October 19, Bitwise on October 20, CoinShares and Canary Capital on October 23, and WisdomTree on October 24. Each decision could serve as a catalyst for market movements, with the potential for cumulative effects if multiple approvals occur.

November brings another high-stakes decision, with Franklin Templeton's application due on November 14. Given the firm's prominence in traditional finance, a green light here could bridge the gap between crypto and mainstream investment channels. Market participants are divided on whether institutional adoption will validate XRP's legitimacy or expose regulatory hurdles that remain unresolved.

Amplify Files for First XRP Income ETF With Options Strategy

Amplify Investments has submitted a groundbreaking proposal to the SEC for the first XRP-based option income ETF. The fund, designed to track XRP's price through linked instruments rather than direct holdings, will employ a covered-call strategy to generate monthly payouts. This approach sidesteps custody risks while capitalizing on crypto volatility.

The Illinois-based firm aims to list the ETF on Cboe BZX Exchange, tapping into growing institutional interest following recent regulatory clarity for XRP. Derivatives-based crypto funds have historically gained more regulatory traction than their spot counterparts—a factor that may prove decisive in Amplify's favor.

Market observers note the filing arrives amid a surge of crypto ETF applications, reflecting Wall Street's accelerating embrace of digital assets. The strategy mirrors traditional income-generating ETF models, now adapted for the crypto era with XRP as its test case.

Gumi Bets Big on XRP: Japan's Strategic Shift Toward Altcoins

Tokyo-listed gaming and blockchain firm Gumi is making a bold move into the crypto space with plans to acquire ¥2.5 billion ($17 million) worth of XRP for its corporate treasury. This isn't speculative gambling—it's a calculated bet on the utility of altcoins with real-world payment applications, particularly in cross-border remittances.

Japan's evolving regulatory landscape is enabling corporations to hold digital assets with greater clarity. Gumi's investment signals a broader trend: Japanese firms are transitioning from headline-grabbing Bitcoin purchases to diversified crypto portfolios. The company's web3 ambitions align with XRP's established payment rails, offering a pragmatic alternative to purely speculative tokens.

Market observers note the timing coincides with hardening compliance standards and clearer accounting treatments for digital assets in Japan. SBI-backed Gumi appears positioned as an early mover in what may become a wave of institutional altcoin adoption.

XRP Tests Key Support Amid Bearish September Start as Whales Accumulate

XRP fell 4% to $2.75 in volatile trading, with institutional liquidations totaling $1.9 billion since July fueling downward pressure. The decline contrasts sharply with whale addresses accumulating 340 million XRP over the same period—a divergence highlighting the asset's contested near-term trajectory.

September's historically weak seasonal trends compound regulatory uncertainty, particularly around unresolved SEC actions. Yet on-chain activity shows symmetrical triangle formations mirroring 2017's pre-breakout conditions, with liquidity clusters suggesting potential upside targets near $4.00 if momentum reverses.

Price action revealed concentrated selling at $2.80, where institutional flows capped rallies. The Aug 31 sell-off saw triple-average volume as XRP tested $2.75 support, with minute-by-minute liquidation spikes confirming forced exits. Technicals now point to $2.50-$2.00 as critical downside zones should current support fail.

Tokyo-listed Gumi Announces Major XRP Purchase to Fuel Global Financial Growth

Gumi Inc., a Tokyo Stock Exchange Prime Market-listed firm, revealed plans for a substantial XRP acquisition on August 29. The strategic move aims to bolster the company's global finance expansion, particularly in remittance services and blockchain-powered revenue streams.

Partnering with SBI Holdings, a Japanese financial giant with established blockchain credentials, Gumi intends to harness XRP's capabilities for fast, low-cost cross-border transactions. This aligns with growing market demand for efficient payment solutions.

The collaboration builds on SBI's existing relationship with Ripple, having previously formed a joint venture to drive XRP adoption across Asia. Gumi's investment signals deepening institutional interest in cryptocurrency's role in modern financial infrastructure.

XRP Price Prediction For September 1

XRP's bullish momentum appears to be fading as the token faces sustained downward pressure. After nearly reaching $3.40 earlier this month, the digital asset has entered a steady retracement phase, validating bearish divergence signals first observed in July.

The weekly chart continues to reflect this bearish divergence pattern, suggesting either further pullback or an extended period of diminished upward movement. Analysts now anticipate this cooling phase may persist through September rather than concluding with August's market activity.

Key technical levels are coming into focus. XRP currently trades below the critical $2.85-$2.90 support zone, a historically significant price range. Bulls must reclaim this territory to stabilize the asset. Failure could see prices test August's low of $2.75, with a breach potentially opening the door to $2.55-$2.62 support levels.

A descending triangle formation adds to the technical concerns, with resistance solidifying near the $3 mark. Market participants are watching these developments closely as September trading begins.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and fundamental catalysts, XRP's price trajectory shows significant potential across multiple time horizons. For 2025, the imminent ETF decisions and regulatory clarity could propel XRP toward the $5-7 range, with technical resistance at $3.00 serving as the immediate target. Looking toward 2030, institutional adoption and broader cryptocurrency integration into global finance could drive XRP to the $15-25 range, assuming successful ecosystem development and regulatory acceptance.

By 2035, as blockchain technology becomes more deeply embedded in financial infrastructure and cross-border payments, XRP could reach $40-60, leveraging its established position in the payments space. The 2040 outlook becomes more speculative but could see XRP reaching $100+ if it captures significant market share in global remittances and central bank digital currency integrations.

| Timeframe | Conservative Target | Moderate Target | Optimistic Target | Key Catalysts |

|---|---|---|---|---|

| 2025 | $3.50 | $5.00 | $7.00 | ETF Approvals, Regulatory Clarity |

| 2030 | $15.00 | $20.00 | $25.00 | Institutional Adoption, Payment Integration |

| 2035 | $40.00 | $50.00 | $60.00 | Global Financial Infrastructure |

| 2040 | $80.00 | $100.00 | $150.00 | CBDC Integration, Market Dominance |

These projections assume successful navigation of regulatory environments, technological advancement, and broader cryptocurrency market growth. Always conduct personal research and consider market volatility.